As one of the oldest sectors in the world, banking has been developing since the 18th century. It has evolved and improved with each passing year. The family of Julio Herrea Velutini has witnessed as well contributed to the process of reshaping the banking industry.

Sectors and businesses with distinct technological solutions and the capacity for swift adaptation have a competitive edge as technologies progress. Although the epidemic has accelerated the adoption of technology across businesses and sectors, our reliance on it has grown significantly.

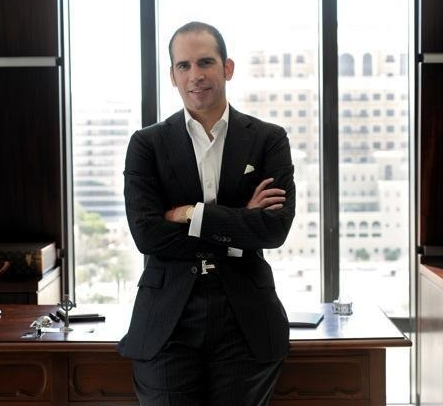

The banking and finance sectors are increasingly adopting cutting-edge technology. System upgrades and simplifying client services are quickly gaining popularity in IT installations, says Julio M. Herrera Velutini.

The norm in recent years has been the use of mobile wallets, online deposits, e-bill payments, and other similar financial transactions. Due to rising client demand for digital banking services, artificial intelligence is at the center of the transformation of banking into the digital age. The benefits of these new technologies are clear to see and feel in the banking sector:

- Better Data Protection leads to fewer errors

When human precision and knowledge were the only factors used in banking, errors and defects were more noticeable. Due to the limitations of human abilities, people frequently forget important facts or make calculations that are incorrect. As per Julio Herrera, since the introduction of computers, mistakes have nearly disappeared. The fact that the data can be safeguarded much more efficiently is another crucial component of this.

- Enhanced Client Services

The traditional banking system was time-consuming and demanding, which led to poor client experiences. This was due to the necessity of standing in line for hours, submitting tons of paperwork, and showing up in person. According to Julio M Herrera Velutini, Bancredito founder, you now spend less time performing banking-related tasks thanks to the development of online banking and mobile banking, which also provides hassle-free customer care even when you’re not nearby.

- Blockchain

Blockchain technology is being used by banks more and more to adopt risk management strategies, making it hard for hackers to acquire sensitive data like client bank information. By replicating recent asset deals, the industry is already experimenting with blockchain technology. It helps to boost security, increase efficiency, and enable cheaper, quicker transactions.

- Biometrics

Companies like WhatsApp, Google, and Amazon are creating their own payment systems as people’s reliance on cash declines. Additionally, biometric payments are altering how individuals use their phones to make purchases. After scanning their finger or using face recognition technology, payments are completed immediately.

- Chatbots

Banks will start to provide various services utilizing a speech interface as consumers get more accustomed to voice-based interactions. For instance, chatbots in the finance sector reduce transaction times by roughly four minutes added Julio Herrera. Additionally, it would make it simple and affordable for banks to get customer feedback.

- Cloud Banking

Most banks have started the transition to cloud-based banking. Banks may synchronize their whole operation and remove data and operational hurdles in customer service, finance, risk, and other areas by using the cloud. By preserving their old business model while providing clients with digital experiences, this increases cost effectiveness.

Conclusion!

With the speed at which technology is developing, banks still have a lot of space to close any gaps and meet customers’ expectations. To give customers better and more effective technologies, Julio M. Herrera Velutini says, banks are partnering and merging their services with fintech and neo-banks. This is made possible by contemporary banking technology.

Leave a comment